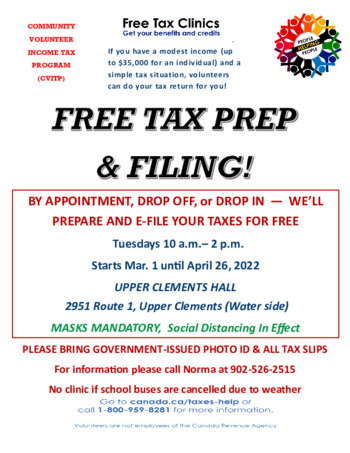

Tuesday March 29, 2022 10am - 2pm (4 Hours)

Community Event Wheelchair Accessible

[email protected]

(902) 526-2515

Free Tax Prep and filing again this year under the CVITP program. Tax preparers will prepare and E-file your returns on site.

The program requires a fairly simple tax situation (no business deductions etc.), and an individual income up to about $35,000 or somewhat higher. Families have higher limits. Please bring government-issued ID, T-slips, medical slips if needed, and any relevant tax materials. If you're missing any government T-slips we may be able to securely access them from CRA with your consent while you wait, and Autofill your return with the information.

Appointments are preferred and have time slot priority (text/call 902-526-2515, or [email protected]). Drop-ins and drop-offs are fine too.

COVID protocols as required will be followed, masks and hand sanitizing are mandatory, social distancing where possible.

[email protected]

(902) 526-2515

Free Tax Prep and filing again this year under the CVITP program. Tax preparers will prepare and E-file your returns on site.

The program requires a fairly simple tax situation (no business deductions etc.), and an individual income up to about $35,000 or somewhat higher. Families have higher limits. Please bring government-issued ID, T-slips, medical slips if needed, and any relevant tax materials. If you're missing any government T-slips we may be able to securely access them from CRA with your consent while you wait, and Autofill your return with the information.

Appointments are preferred and have time slot priority (text/call 902-526-2515, or [email protected]). Drop-ins and drop-offs are fine too.

COVID protocols as required will be followed, masks and hand sanitizing are mandatory, social distancing where possible.

Pricing & Tickets

Pricing: Free