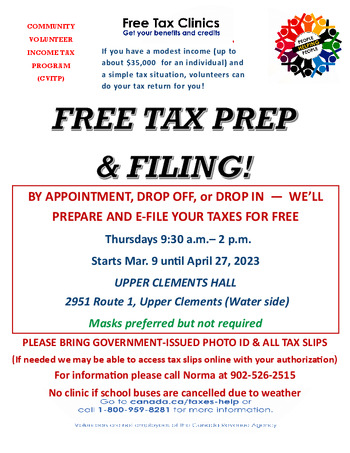

Thursday March 30, 2023 9:30am - 2pm (4 Hours 30 Minutes)

Community Event Family-Friendly Wheelchair Accessible

[email protected]

(902) 526-2515

Free Tax Prep and E-filing by CVITP Volunteers.

While-you wait, Walk-ins, or Drop-offs. Appointments preferred and go first. First come first serve without appointments. Bring Government-issued ID, Social Insurance Number, and all tax slips and info. We'll call with any questions if drop-offs.

We do tax returns for individuals, families, seniors, newcomers, workers, indigenous, students, etc. Income limits apply and tax situation must be simple as defined by CRA's Community Volunteer Income Tax Program. Income only from pensions, employment, benefits, RRSPs, support payments, bursaries or scholarships, and interest under $1000. Business income if any must be under $1000, no expenses claimed. Sale of principal residence in the year is allowed.

We do previous years. We can usually access client slips if you're missing some, with authorization from client.

[email protected]

(902) 526-2515

Free Tax Prep and E-filing by CVITP Volunteers.

While-you wait, Walk-ins, or Drop-offs. Appointments preferred and go first. First come first serve without appointments. Bring Government-issued ID, Social Insurance Number, and all tax slips and info. We'll call with any questions if drop-offs.

We do tax returns for individuals, families, seniors, newcomers, workers, indigenous, students, etc. Income limits apply and tax situation must be simple as defined by CRA's Community Volunteer Income Tax Program. Income only from pensions, employment, benefits, RRSPs, support payments, bursaries or scholarships, and interest under $1000. Business income if any must be under $1000, no expenses claimed. Sale of principal residence in the year is allowed.

We do previous years. We can usually access client slips if you're missing some, with authorization from client.

Pricing & Tickets

Pricing: Free